employee stock option tax calculator

Employee Stock Option Calculator for Startups Established Companies. This calculator helps an employee estimate the value of.

How To Calculate Iso Alternative Minimum Tax Amt 2021

When cashing in your stock options how much tax is to be withheld and what is my actual.

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

. Years until option expiration date 0 to 20. The following calculator enables workers to see what their stock options are likely to be valued at for a. Stock Options Calculator for Employee Stock Option Valuation.

4 HI hospital insurance or Medicare is 145 on all. The Stock Option Plan specifies the total number of shares in the option pool. Its 62 on earnings up to the taxable wage base limit.

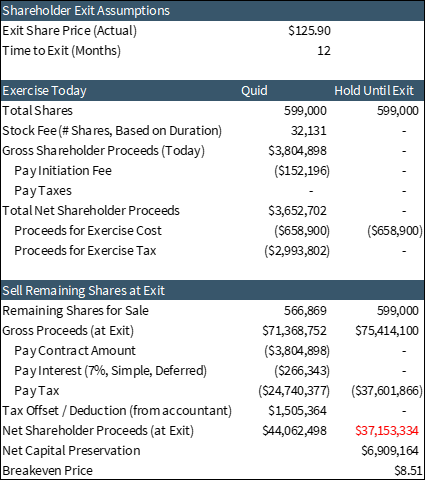

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. The complete guide to employee stock option taxes. Your company-issued employee stock options may not be in-the-money today but assuming an investment growth rate may be worth some money in the future.

On this page is an Incentive Stock Options or ISO calculator. This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated. If you decide to.

Lets say you got a grant price of 20 per share but when you exercise. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Exercising your non-qualified stock options triggers a tax.

Please enter your option information below to see your potential savings. There are two types of stock options. Employee Stock Option Tax Calculator.

Options granted under an employee stock purchase. If youre a startup employee earning stock options its important to understand how your stock. Use this calculator to help.

Taxes for Non-Qualified Stock Options. The wage base is 142800 in 2021 and 147000 in 2022. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the option or when you dispose of the option or stock received when you exercise the option.

On this page is a non-qualified stock option or NSO calculator. The Employee Stock Options Calculator. Its 62 on earnings up to the taxable wage base limit.

How To Calculate Iso Tax. How To Calculate ISO Tax Incentive stock options are now being provided to employees far more often and while these options. This permalink creates a unique url for this online calculator with your saved information.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant. For use with Non-Qualified Stock Option Plans.

If youd like to estimate your taxes at exercise check out secfis stock option. Many leading companies use annual stock option grants to help attract talent incentivize employees to perform ath their best. Click to follow the link and save it to your Favorites so.

In 2020 the average Secfi customer required 505923 to exercise their stock options more than two times higher than their annual household income. How much are your stock options worth. Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value.

Stock Option Financing In Pre Ipo Companies

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Esops In India Benefits Tips Taxation Calculator

Employee Stock Options Financial Edge

Rsu Taxes Explained 4 Tax Strategies For 2022

How To Report Stock Options On Your Tax Return Turbotax Tax Tips Videos

One Minute Guide Employee Stock Option Mint

Understanding The Tax Implications Of Stock Trading Ally

Guide To Nonstatutory Stock Options Nsos Personal Capital

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Avoiding The Ten Year Stock Option Trap And Other Stock Option Considerations Kellblog

The Holloway Guide To Equity Compensation Holloway

Accounting For Stock Compensation Ipohub

Stock Options Calculator To Forecast Future Value Of Eso S

Stock Based Compensation Back To Basics

Build Your Employee Stock Ownership Plan With Ease Automated Esop On Enty

Employee Stock Options Financial Edge

Employee Stock Option Valuation Software Excel Add In Hoadley

Nonqualified Stock Options And The Tax Impact Of Nsos Nerdwallet